Use of Home as Office

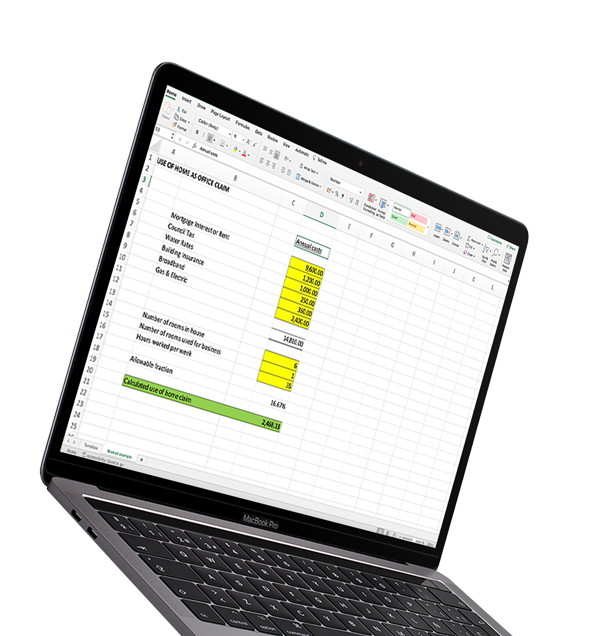

If you are running the business entirely from home you will be able to make a claim for using your home as an office. This simple but affective spreadsheet will enable you to see what you can claim.

- NO EXPERIENCE NEEDED

The amount you can claim is dependent on the number of rooms used for your business and how many hours you work each week on average.

What's inside?

To help you calculate this. The template has two tabs. One tab can be used as a calculator to work our your claim. The second tab is for information only, and shows a worked example to help identify where you need to make the entries.

You will need to complete the cells highlighted in yellow on the ‘Template’ tab. Your use of home as office claim will be the highlighted green cell on the ‘Template’ tab.

The amount you will have calculated your Use of Home as Office as office claim based on the information you provided on the spreadsheet. As this is usually more than the HMRC allowance of £312 per year it is possible that HMRC could query this claim. Should they do this you would need to provide evidence of the household expenses used in the calculation.

If you are unsure of anything, please contact BarrettStacey Accounting, we can get you registered as a client for a one off fee of £50 and provide you with an affordable payment plan for your Self Assessment submission. This would save you time, and stress knowing that your Self Assessment has been prepared and reviewed, by not 1 but 2 qualified Accountants.

About the author

Hayleigh Barrett

Founder, Managing Director

Download your free copy now!

Your details will only be used within BarrettStacey Accounting.